Reports, videos and workshops

Are inheritance taxes unfair?

People like the myth of the ‘self-made’ man or woman.

Donald Trump, for example, appeals to his followers as an ordinary guy who built his business empire with only a “small loan” of one million dollars from his father. The truth, however, is that Trump received upwards of $400 million from Fred Trump over his lifetime. The point being: it’s much easier to make money if you start rich.

Wealthy people have inbuilt advantages over the less prosperous: they can afford better education and healthcare, they have easier access to capital if they want to start a business, they have greater opportunities and better life chances. Most people are comfortable about wealth disparities in society, as long as the game feels fair (i.e. they accept unequal outcomes as long as there are equal opportunities).

What do ours readers think?

We had a comment from Kimmo, who argues that inheritance tax is a form of double taxation because the income has already been taxed at the point it was first earned. Why should it be taxed again?

We also had a comment from Duncan, who said that when a wealthy person inherits money they can invest it into making them (and their children) even more advantaged, meaning that inequality perpetuates. Is this a problem?

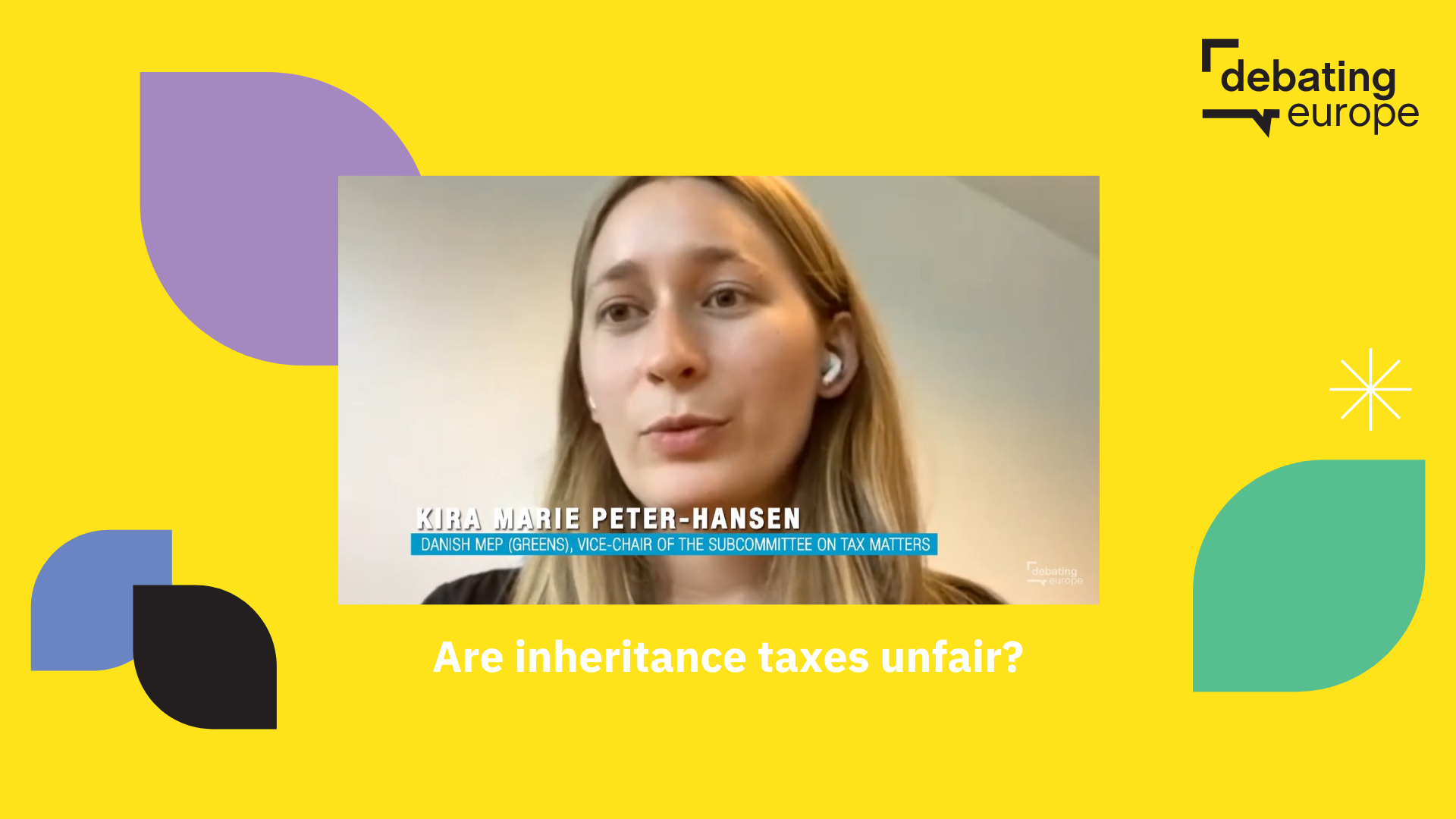

To get a reaction, we put Kimmo and Duncan’s comments to Kira Marie Peter-Hansen, a Danish MEP who sits with the Group of the Greens/European Free Alliance in the European Parliament and is Vice-Chair of the Subcommittee on Tax Matters. You can see her responses in the video above.

Are inheritance taxes unfair?

Does it represent a form of double taxation? Or is inheritance tax an effective way to reduce inequality?

Funded by the European Union. Views and opinions expressed are however those of the author(s) only and do not necessarily reflect those of the European Union or the European Commission. Neither the European Union nor the granting authority can be held responsible for them.![]()